What Are Longevity Credits?

J

une is Annuity Awareness Month, so I thought I'd show you how to talk with clients and prospects without even using the word annuity until the end.

As you know, longevity risk is the number-one risk in retirement because it multiplies all the other risks. The longer you live, the more likely you'll withdrawal too much. The longer you live, the more likely you'll see inflation. The longer you live, the more likely you'll need long-term care. So how do you mitigate that risk? Longevity credits! But what the heck are longevity credits? Let me tell you a simple story you can use to explain this to clients.

Every year, five 90-year-old ladies went on vacation. One year, one of the ladies had an idea. She said, "Why don't we each put $100 into a mason jar, seal it up, and bring it with us next year? That year, we'll open it up, and those of us who are still alive will split the money." The others said, "Hey, that's a great idea!" So, all five of them put in $100 (that's $500 total), and they sealed up the jar.

What do you think happened the next year? They forgot where they put the jar! No, that's just a joke. Unfortunately, one of the old ladies passed away. So now, the four old ladies who were still alive opened the jar and split the money - $125 each. That's a 25% rate of return in 12 months. They had no money in the market, and there was no interest rate. How do think they each got paid 25%? That 25% is from longevity credits!

The ladies looked at this, thought it was a great deal, compared it to their brokerage account, and they decided to do it again. So, they put the money back in the jar, sealed it up, and decided to "let it ride." The next year one more old lady passed away. Now, three ladies split the $500. They got $167, which is a 67% rate of return over two years with no money in the market and not interest. How is this possible? Because they got paid longevity credits.

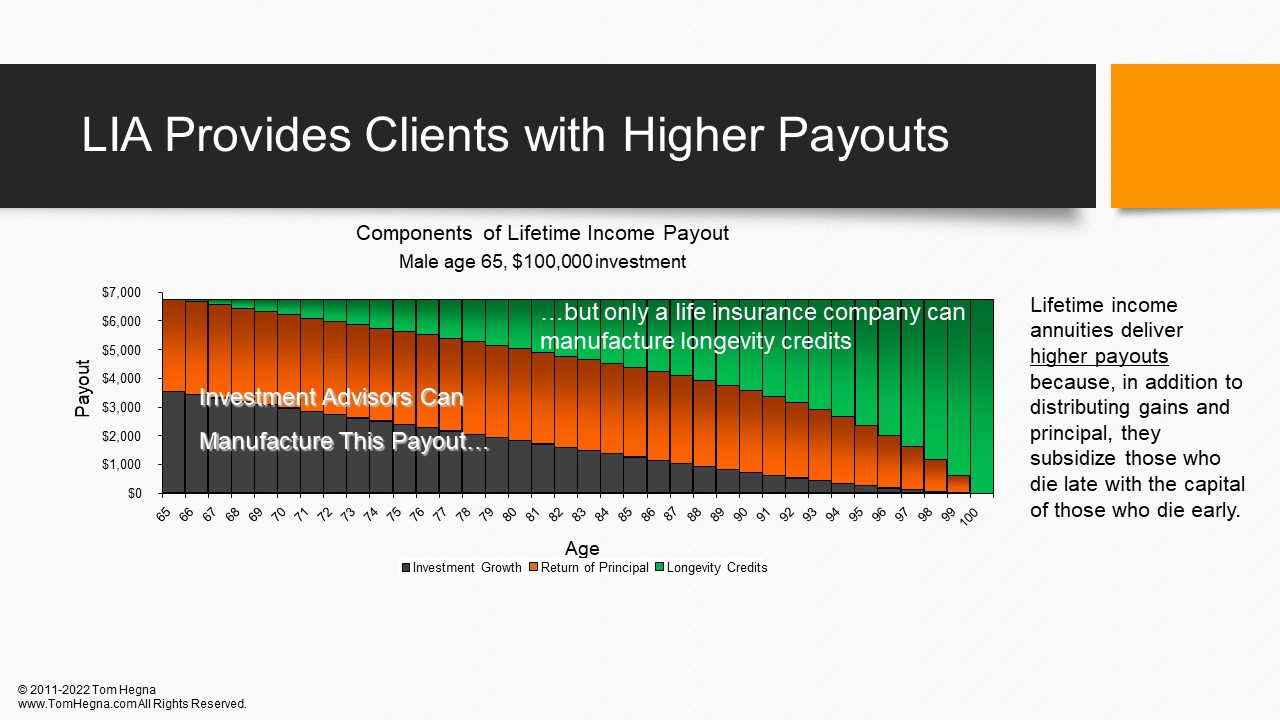

Let me explain it another way. Look at the chart below from one of my presentations. Those gray bars represent principal - anyone can pay you that. The orange bars represent interest - anyone can pay you that too. The green bars represent longevity credits, and only a life insurance company can manufacture those! What available investments can pay you based on your age? Stocks can't do it. Bonds can't do it. The only product that can deliver higher payouts based on how long you live is a lifetime income annuity.

Notice that I never used the word "annuity" until the end. That's your time to shine. Clients and prospects can be warmed up with the story, so once you mention financial products, you can show them why it's so important to work with a professional. Use stories like this to educate your clients for annuity awareness month, and if you want to hear more of them, join me for a free online session I call, "Seven Simple Steps and Stories that Sell." See when the next session is available at https://tomhegna.com/storieswebinar.

I hope to see you there!

-Tom Hegna